Raw Spread vs Standard Account: What’s better?

BY TIOmarkets

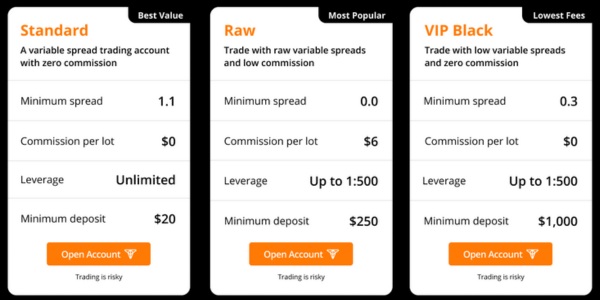

|February 11, 2025Two popular trading account options for traders to choose from are the Raw spread and Standard accounts. These account types cater to the needs of traders across all experience levels, providing flexibility in terms of cost structures but are they created equal?

Understanding the differences between the raw spread vs standard account can contribute to enhancing your trading strategies profitability by reducing your overall trading costs.

In this article, we will compare TIOmarkets raw spread vs standard account so you can choose the trading account that is right for you. Continue reading to learn more.

Raw spread vs Standard account

When choosing between a Raw Spread and a Standard account, it is crucial to understand their distinct characteristics and differences.

Raw Spread accounts are renowned for offering tighter spreads and separate trading commissions. While Standard accounts have higher spreads and all transaction fees are built into the spread.

Raw spread and Standard account transaction fees

When comparing the costs of trading on a Raw Spread vs Standard account, it is important to consider both the spread and commission as a cost of trading.

The spread is the difference between the bid and ask prices of a currency pair. The per lot commission is a fee that brokers charge for executing trades on your behalf. When you trade with a Raw Spread account, you pay both the spread and the commission. When trading on a Standard account, you only pay the spread.

Therefore, to get a true comparison of the costs of trading for the Raw spread account, the commission fee should be converted to the spread equivalent and added to the spread. This will then provide a like for like comparison of the cost of trading on the raw spread vs standard account.

Standard account transaction fees

For the purpose of this calculation, let's use the Forex market as an example, where a standard lot (1.0) is 100,000 units of the base currency. For currency pairs where the USD is the quoted currency, the value per pip for a standard lot traded is worth $10.

Given that the minimum spread on TIOmarkets Standard account is 1.1 pips, and assuming each pip is worth $10, the minimum cost to open a trade will be ($10 x 1.1 pips) $11 per standard lot. As there is no separate per lot commission on the Standard account, there is nothing more to add to the cost of executing a trade on this account type.

So the minimum transaction fee on the Standard account is calculated as follows:

- Fees related to spread = $11 per lot.

- Commission per round turn lot= $0

- Total minimum execution fee = Spread + Commission

- Total minimum execution fee = $11 + $0 = $11 per lot

Raw spread account transaction fees

We will use the Forex market as an example for this calculation as well. For currency pairs where the USD is the quoted currency, the value per pip for a standard lot traded is worth $10.

Given that the minimum spread on TIOmarkets Raw spread account is 0.0 pips, the minimum cost to open a trade as far as the spread is concerned will be ($10 x 0.0 pips) $0 per standard lot. However, the Raw spread account has a separate $6 per lot commission that needs to be taken into account.

So the minimum transaction fee on the raw spread account is calculated as follows:

- Fees related to spread = $0 per lot.

- Commission per round turn lot = $6

- Total minimum execution fee = Spread + Commission

- Total minimum execution fee = $0 + $6 = $6 per lot

Raw spread vs Standard account fees comparison

This comparison shows that when the minimum spread and per standard lot commission is taken into account, the raw spread account is $5 per lot cheaper compared to the standard account.

It is nearly 55% cheaper to execute trades on TIOmarkets Raw spread account vs Standard account.

| Transaction fee type | Raw spread account | Standard account |

| Spread | From $0 | From $11 |

| Commission (per lot) | $6 | $0 |

| Minimum total fee | $6 per lot | $11 per lot |

With that being said, different symbols have different spreads, so the savings could be even more or slightly less depending on what you trade. Further to this, other fees associated with trading may apply and this can include funding fees and swaps. Fees related to deposits and withdrawals will depend on the amounts and funding methods used. Swaps for the symbols on the raw spread vs standard account will be consistent regardless of the account type you trade on.

Leverage on the Raw spread vs Standard account

Trading with leverage allows you to control larger positions with a smaller amount of capital. For example, with a leverage of 1:500, you can control a position of $100,000 with just $200 of your own capital. This can significantly amplify your potential to profit, but it also increases the risk of loss when not used responsibly. While trading without or lower amounts of leverage offers lower relative risks, it requires larger amounts of capital to trade.

See the table below to learn more about the role of leverage and margin on your trading,

| Leverage | Lot size | Margin requirement | Pip value |

| 1:1 | 0.10 | 100% or $10,000 | $1.00 |

| 1:30 | 0.10 | 33.3% or $333.33 | $1.00 |

| 1:100 | 0.10 | 1% or $100 | $1.00 |

| 1:200 | 0.10 | 0.5% or $50 | $1.00 |

| 1:500 | 0.10 | 0.2% or $20 | $1.00 |

| Unlimited | 0.10 | Not applicable | $1.00 |

Standard account leverage options

On the Standard account offered by TIOmarkets, you can trade with up to unlimited leverage, enabling you to amplify lot sizes without the constraints of traditional leverage and margin ratios. The main benefits of trading with unlimited leverage includes increased position sizes, efficient capital utilization, and enhanced trading flexibility. With no margin being withheld as collateral against your open deals when opting to trade with unlimited leverage, it allows you to utilize all of your funds to trade with.

Raw spread account leverage options

On the other hand, trading with traditional leverage ratios still allows you to control larger positions in the market with a smaller amount of capital. However some of your funds will be tied up as collateral on open deals. All leveraged trading requires robust risk management strategies, such as stop-loss orders and appropriate lot sizing to mitigate the increased risk.

On the TIOmarkets Raw spread account, you can trade with up to 1:500 leverage (on request), providing you with ample leverage on a minimal amount of capital withheld as margin.

Advantages of higher leverage

- Potential for higher returns: By opening larger positions, traders can amplify their profit potential, maximising the performance of a high-quality trading strategy.

- Capital efficiency: Higher leverage allows traders to use more of their account balance for trading. This means that every dollar in the account can be utilised to open larger or more positions, potentially leading to higher profits (or losses).

- Enhanced trading flexibility: With lower margin requirements, traders can quickly adapt to changing market conditions and take more trading opportunities. Compared to traders that have leverage restrictions and higher margin requirements.

Disadvantages of higher leverage

- Higher risk of loss: The same mechanism that increases the potential for higher gains, equally magnifies the potential risks. A small adverse price movement can lead to significant financial losses.

- Risk of over-leveraging: Traders might be tempted to over-leverage and trade with larger lot sizes. This can lead to rapid account depletion, especially in volatile markets.

- Less room for error: The higher the leverage used, the greater the accuracy that is required in terms of trade entry and effective risk management is essential.

- Psychological pressure: Trading with high leverage can be psychologically taxing. The stress of managing large positions and the potential for significant losses can impact decision-making, leading to impulsive trades and mistakes.

Always remember, when trading with leverage, especially at higher ratios, the key is not just to focus on the high potential returns but to equally consider the risks and manage your exposure effectively.

Raw Spread vs Standard account funding options

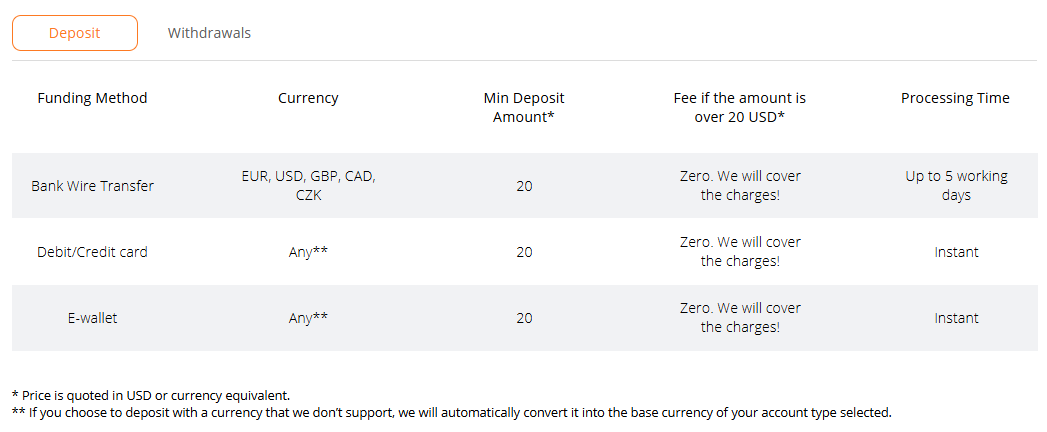

There is not much difference with your funding options between the Raw spread account and the Standard account. Both account types allow you to deposit and withdraw conveniently using your debit or credit card, bank wire transfer, e-wallet or crypto.

As long as you deposit and withdraw the minimum amount, you will not incur any processing fees.

There are also several account base currency options to choose from when creating your raw spread or standard account, and the minimum starting amount depends on what you choose. The Raw spread account has a minimum deposit starting from US $250, versus the Standard account that has a minimum starting deposit from US $20.

| Minimum Deposit | Raw spread account | Standard account |

| USD | $250 | $20 |

| EUR | €250 | €20 |

| GBP | £250 | £20 |

| AUD | $375 | $30 |

| CAD | $375 | $30 |

| ZAR | R6250 | R500 |

| AED | 875د.إ | 75د.إ |

Advantages of Raw spread account

TIOmarkets Raw spread account offers spreads from 0.0 pips, the trading costs associated with the bid/ask spread are lower compared to the standard account, which includes markups. This account type is a better option for traders who want to trade with tighter spreads and lower transaction fees overall. Lower transaction fees can potentially lead to better profitability, especially for high volume traders.

Advantages of Standard account

The Standard account is a better option for traders who want a simple fee structure and zero commission. The Standard account includes all the transaction fees in the spread. It also has a much lower minimum deposit amount to get started at just US $20.

Raw spread or Standard account: What is better?

Choosing between the Raw spread account and the Standard trading account largely comes down to your individual trading needs and preferences. The raw spread account is well-suited for traders who are looking for lower spreads and don't mind paying separate execution commission fees. This account type is an attractive choice for high-volume traders, or those who want lower overall trading fees.

On the other hand, the standard account is more appropriate for beginner traders or those who prefer a simpler fee structure. All transaction fees are built in to the spread. The Standard account also has a lower minimum deposit requirement to get started, compared to the Raw spread account. So it is well suited to traders interested in starting with a small amount first.

Register your Raw spread or Standard account.

Learn about other forex trading accounts

- Forex nano account

- Forex cent account

- Forex micro account

- Forex mini account

- Forex low fee trading account

- Forex copy trading account

- Forex demo account

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.