The Bank of England's next move | The future of UK interest rates

BY TIOmarkets

|May 6, 2025The Bank of England's interest rates are back under scrutiny, as economic challenges remain on the horizon. With global trade uncertainties and fluctuating inflation rates, the upcoming decisions by the Monetary Policy Committee (MPC) have garnered significant attention.

The trade policies introduced by U.S. President Donald Trump has cast a long shadow, influencing expectations of rate cuts in the UK.

This article explores the anticipated changes, the potential impacts on the UK economy, and the implications it could all have for consumers and the financial markets.

Keep reading to learn more and be prepared for the trading opportunities ahead.

Anticipated rate cuts due to economic uncertainties

The Bank of England is widely expected to reduce interest rates in response to the economic pressures stemming from trade tariffs on Thursday, 8th May. According to data available on our economic calendar, analysts are predicting a 25 basis point reduction from 4.5% to 4.25%.

However, some economists think that a more aggressive approach is needed, advocating for a half point reduction to 4%. This sentiment is echoed by certain members of the Monetary Policy Committee (MPC) too, who are concerned about the potential for a recession due to a slowdown in global trade.

The International Monetary Fund (IMF) has downgraded its growth forecast for the UK for 2025, highlighting the broader economic impact of these tariffs. The downgrade underscores the urgency for the Bank of England to act decisively to maintain UK economic stability and consumer confidence.

Inflation and growth concerns

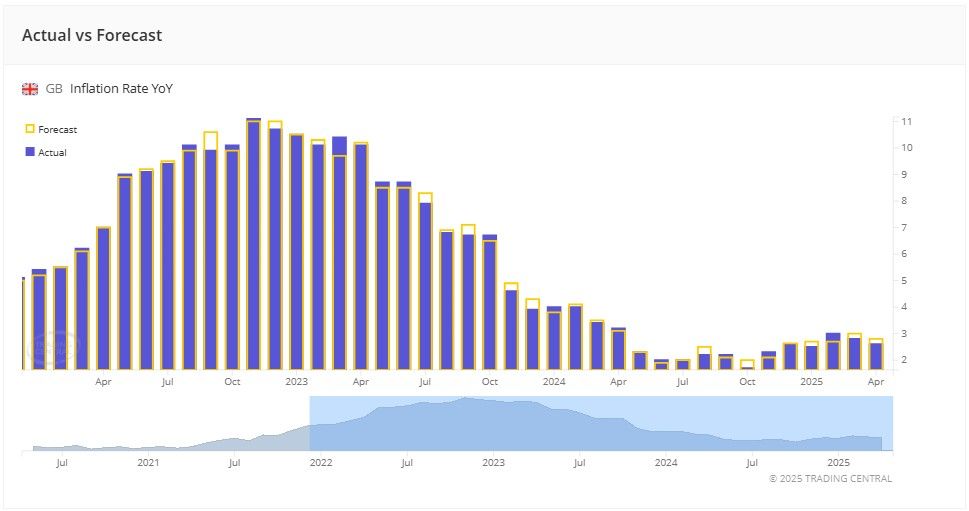

UK inflation was recorded at 2.6% in March, but projections suggest a rise to 3.7% in the summer due to escalating energy and food prices. Although this remains a predicted increase, the potential trend in inflation poses a challenge for the Bank of England's decision making, which aims to steer inflation towards its 2% target. The central bank's strategy involves adjusting interest rates to influence borrowing and spending behaviours, with the ultimate goal of stabilizing inflation.

The economic landscape is further complicated by economic growth concerns. Analysts have varied predictions for the trajectory of interest rates, with some anticipating multiple cuts throughout the year. A reduction to 3.75% or even 3.5% by the end of 2025 is possible if current economic conditions persist.

Impact on mortgages, loans and savings

According to the government's English housing survey reported on the BBC, approximately a third of households have a mortgage and approximately 600,000 UK homeowners have mortgages that track the Bank of England's base rate. The majority of mortgage holders have fixed-rate deals, which remains unaffected by short-term rate adjustments. Interest rate changes have a direct effect on mortgages and loans so any reductions could potentially offer some relief on their repayments.

For savers, a falling base rate may lead to reduced returns and as interest rates decline, the average rate on easy access savings accounts could drop, impacting those who rely on interest as a supplement to their income. Conversely, lower borrowing costs could stimulate consumer spending, potentially offsetting some negative effects on savings.

Outlook for the UK economy

Recent surveys and trackers by The Which? and reported by the BBC, have revealed a significant drop in UK consumer confidence, reaching its lowest point since December 2022. Nearly two-thirds of the population anticipates worsening economic conditions over the next year. 63% of people cited changes in prices, and 60% cited government tax changes as reasons for their economic concerns. While 47% of tenants said they missed rent payments in the recent past. An estimated 13 million households, or 46%, made adjustments to cover essential spending, including cutting back on essentials, dipping into savings, selling possessions, or borrowing money.

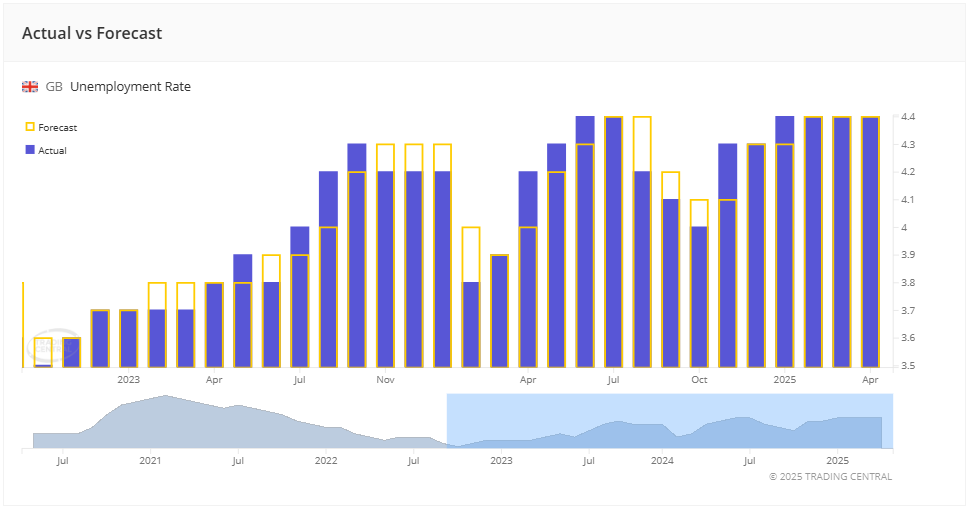

The job market adds another layer of potential uncertainty to an already volatile economic environment. Economic indicators show the unemployment rate holding steady at 4.4% but the general trend shows that it has been ticking upwards since October 2022.

Economists caution that the efficacy of the Bank of England's rate cuts may be limited unless accompanied by broader economic reforms. The Institute for Fiscal Studies has raised alarms about a potential fiscal shortfall exceeding £50 billion, emphasizing the need for a comprehensive approach to economic management. Despite these concerns, the Labour government under Chancellor Rachel Reeves has yet to articulate a clear economic strategy beyond monetary interventions.

While consumer confidence and employment figures paint a negative outlook for the UK economy, proactive measures and comprehensive strategies have the potential to steer the economy towards stability and growth.

Potential scenarios from the BoE interest rate announcement

The actual rate is as expected

If the BoE announces the widely expected 25 basis point reduction, bringing the base rate to 4.25%, this would align with analyst forecasts and suggest a balanced response to the dual challenge of inflation and growth concerns.

With limited surprises for traders, the GBP could remain stable or exhibit modest volatility as the decision is already priced in and equities might react positively to the news.

The actual rate is less than forecast

If the BoE chooses to leave interest rates unchanged at 4.5%, or reduces it minimally instead of the forecasted 25 basis points, this could indicate restraint in response to inflationary pressures.

The GBP might strengthen as traders interpret this decisions as hawkish relative to expectations. Stocks might experience a sell-off or a muted response as borrowing costs will remain higher than expected. Bond yields could rise as traders adjust to potentially fewer rate cuts down the line.

The actual rate is greater than forecast

If the BoE announces a higher than expected rate cut, exceeding the anticipated 25 basis point reduction, this may signal the urgency of addressing recessionary pressures and growing inflation risks.

The GBP could weaken significantly as traders price in a more aggressive easing cycle and diminished returns for GBP-denominated assets. Stock may rally, especially sectors that benefit more from lower financing costs.

Are you ready to trade the BoE interest rate announcement?

In either scenario traders should be prepared for volatility across all GBP related asset classes leading up to, during and after the event.

The Bank of England's interest rate announcement has the potential to cause considerable price movements, offering traders opportunities and risks.

The key markets to watch are GBP/USD, EUR/GBP, GBP/JPY, bank and fast moving consumer goods stocks, as well as UK bonds.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.