What is Forex Trading and How Does it Work?

BY Chris Andreou

|February 21, 2025Forex trading, or foreign exchange trading, is the buying and selling of currencies in the Forex market.

The Foreign exchange market is a decentralized banking network that operates 24 hours a day, five days a week. It is the largest and most liquid financial market in the world, with an average daily trading volume exceeding $7.5 trillion.

This is a complete guide to help you understand what Forex trading is and how it works. Including the mechanics of Forex trading, factors that influence the Forex market and the strategies traders use to try to profit from exchange rate fluctuations.

So without any further delay, let’s get started.

What is Forex trading?

The foreign exchange market plays a critical role in global trade and finance, its evolution is a fascinating journey through time, displaying the ingenuity and adaptability of financial markets.

The gold standard era

The genesis of what we understand as the Forex market today can be traced back to the late 19th century with the adoption of the Gold Standard. Implemented in 1875, the Gold Standard was a system in which countries agreed to convert paper money into a fixed amount of gold. This standardization of currency exchange promoted stability in international trade by eliminating exchange rate risk.

However, the Gold Standard had its limitations, notably during major geopolitical events like World War I, where countries needed the flexibility to print more money to fund military expenditures. This led to the suspension of the Gold Standard during the war, exposing its fragility under extreme economic pressures.

The Bretton Woods system

The Bretton Woods Agreement in 1944 heralded a new era in the history of Forex markets. In response to the limitations of the Gold Standard and in anticipation of post-war economic recovery, allied nations convened in Bretton Woods, New Hampshire, to create a more flexible monetary system. The outcome was the establishment of fixed exchange rates, where currencies were pegged to the US dollar and convertible to gold at a fixed rate.

This system aimed to ensure exchange rate stability and prevent competitive devaluations. However, as economies around the world started growing at different rates, maintaining the fixed exchange rate system became increasingly untenable.

The free-floating system

The pressures on the Bretton Woods System culminated in 1971, when the US was facing inflationary pressures and depletion of its gold reserves, decided to suspend the gold convertibility of the Dollar. This marked the transition to a free-floating exchange rate system, where the value of currencies is determined by the market forces of supply and demand.

The introduction of floating exchange rates injected volatility into the Forex markets, expanded them and provided opportunities for arbitrage and speculation. This ushered in Forex trading as we know it today.

The digital era

The digitization and technological advancements of financial markets in the late 20th and early 21st centuries, facilitated the emergence of online trading platforms. Enabling retail investors to open brokerage accounts and become Forex traders by speculating in the market with their own capital.

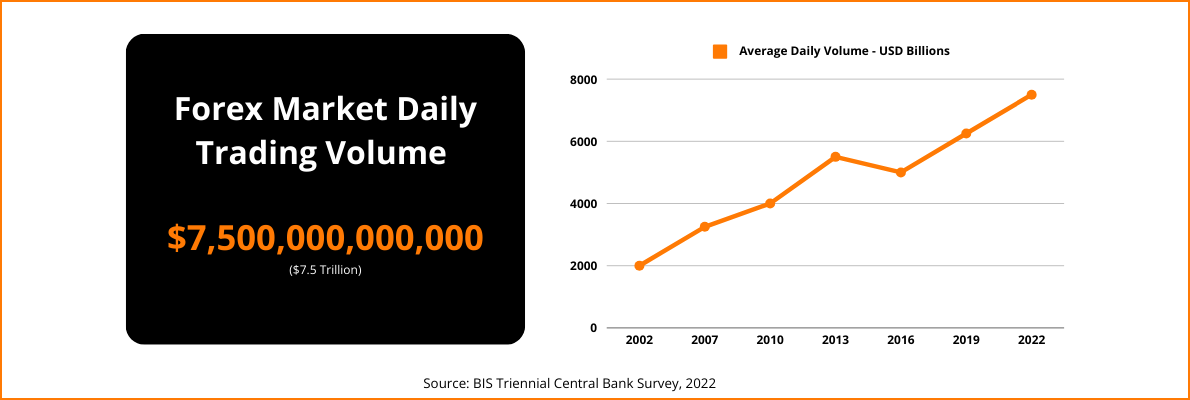

Forex market size

To grasp the enormity of the Forex market, consider that its daily trading volumes surpass the combined total of all the world's stock markets. According to the 2022 Triennial Central Bank Survey of FX and OTC derivatives markets conducted by the Bank for International Settlements (BIS), the forex market's average daily turnover was approximately $7.5 trillion.

This staggering volume not only underscores the market's vastness, but also its liquidity and the high level of activity it experiences on a daily basis.

Most popular currencies traded

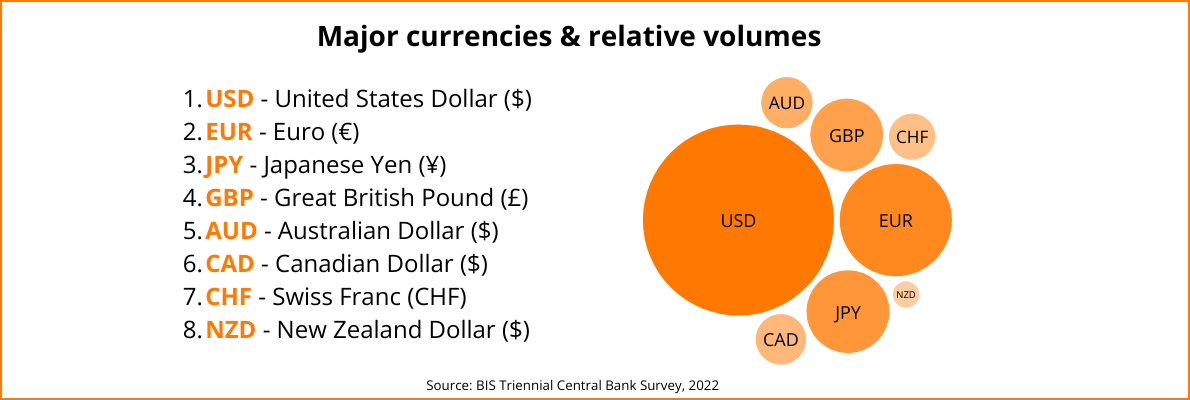

US Dollar (USD)

The USD is the dominant currency in Forex trading and global finance, serving as the world's primary reserve currency. It is involved in approximately 90% of all Forex transactions because it is the preferred medium for international trade and investment. The US Dollar is also regarded as a safe haven currency in times of global economic uncertainty.

Euro (EUR)

The primary currency of the Eurozone is the Euro and it is the currency used by 19 of the 27 member countries that make up the European Union. The Euro was introduced in 1999 and quickly became the second most traded currency in the world. It is valued for its stability and significant economic backing from the European nations, three of which make up part of the G7.

Japanese Yen (JPY)

The foremost currency in Asia is the Japanese Yen and in the Forex market, it is widely used for carry trades due to it being renowned for its low interest rate. It is also known for its volatility during Asian trading hours and a benchmark to gauge economic health across Asia.

British Pound (GBP)

The United Kingdom's Great British Pound is widely recognized for its stability and extensive global economic integration. The GBP is a very liquid currency and was once the world's dominant reserve currency. Otherwise known as Sterling, the GBP continues to be an essential player in international finance.

Australian Dollar (AUD)

Often termed the commodity currency due to Australia's significant commodity exports. The AUD's value often correlates with the prices of gold, iron ore and the other commodities Australia exports. It is seen as a barometer for Chinese economic prospects since China is a major trading partner of Australia.

Canadian Dollar (CAD)

Canada's currency is similarly classified as a commodity currency and its value is directly affected by crude oil prices. Crude oil is one of Canada's primary exports and price movements in the CAD can provide insights into the global energy market.

How Forex trading works

At its core, Forex trading works by simultaneously exchanging one currency for another. This is done for various purposes, which includes fulfilling commercial transactions or for tourism. However, the vast majority of Forex trading is done for speculative purposes, with the objective of profiting from fluctuations in exchange rates.

When trading Forex, you're essentially speculating on the future value of currencies and the direction of the exchange rate between two currencies within a pair.

Currency pairs explained

Currencies are quoted in pairs, for example, the EUR/USD is a currency pair for the value of the euro versus the U.S. dollar. Another currency pair is the GBP/JPY, which is the value of the Great British Pound versus the Japanese Yen.

The major currency pairs

The majors are made up of currency pairs that include the U.S. dollar and a currency of another significant economy. The majors are the most liquid and widely traded currency pairs in the world. Here are the major currency pairs:

- EUR/USD (Euro/U.S. Dollar)

- USD/JPY (U.S. Dollar/Japanese Yen)

- GBP/USD (British Pound/U.S. Dollar)

- USD/CHF (U.S. Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/U.S. Dollar)

- USD/CAD (U.S. Dollar/Canadian Dollar)

- NZD/USD (New Zealand Dollar/U.S. Dollar)

The crosses

Cross currency pairs, or “the crosses”, as they are often referred to, are major currencies paired with each other but do not include the U.S. dollar. Examples of cross currency pairs include EUR/GBP, GBP/JPY, and AUD/NZD. While these currency pairs are less liquid than the majors, they still have enough liquidity to be popular speculative instruments among Forex traders.

The exotics

Exotic currency pairs include the currency of a developing economy or otherwise referred to as an emerging market. Exotic currencies include Brazil's Real (BRL), the South African Rand (ZAR) and the Mexican Peso (MXN). Exotics are usually paired with the U.S. dollar or the euro and they are not traded as frequently as the majors or the crosses.

So now you know what Forex trading is, let's dive deeper into the mechanics of how Forex trading works.

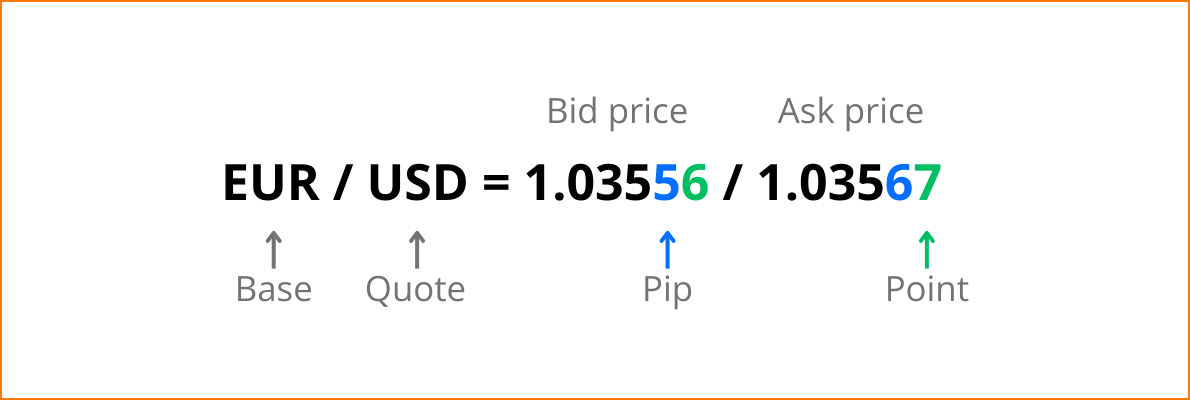

Exchange rates and price quotes

Currency pairs are quoted with a bid and ask price. The bid price is what the broker is willing to pay for the base currency (the first currency in the pair) in exchange for the quoted currency (the second currency in the pair). The ask price is the price at which the broker will sell the base currency in exchange for the quoted currency. The Quote currency is always priced in terms of exchanging one unit of the base currency.

In the example above, one Euro would buy 1.03567 US Dollars (Ask price) and selling 1.03556 US Dollars (Bid price) would buy one Euro. Buy positions involve simultaneously selling the quote currency to buy the base currency, while sell positions would simultaneously sell the base currency to buy the quote currency.

When you believe that the base currency in a pair is likely to strengthen against the quoted currency, you would take a long position (buy) and pay the Ask price. Conversely, if you believe it will likely weaken, or the quoted currency will likely strengthen relative to the base currency, you'd take a short position (sell).

In simple terms, buy the currency pair if you think the price is going to go up or sell the currency pair if you think the price is going to go down.

If your speculation is correct, you would reverse the transaction to close the trade and end up with a profit. On the other hand, if price goes the other way, and you close the trade, you would end up with a loss.

Key terminology in Forex trading

Forex trading operates with its own set of terminology and to new traders this can often seem like a daunting barrier to entry. However, it's not as difficult as it seems and understanding the basic terms and definitions used in Forex markets is essential for anyone looking to participate.

So let’s demystify the most common and basic terminology needed, so you can be equipped with the knowledge to begin your trading journey.

- Bid price: The price at which the Forex market (or your broker) will sell the base currency to you. This is the price you sell at if you think the exchange rate of a currency pair will fall.

- Ask price: This is the price at which the Forex market (or your broker) will sell the quote currency to you. This is the price you sell the base currency to buy the quote currency at if you think the exchange rate of the currency pair will rise.

- Spread: The difference between the bid (sell) price and the ask (buy) price of a currency pair. The spread is essentially part of the cost of trading.

- Long (going long): When a trader takes a long position, they are buying a currency pair with the expectation that its value will increase over time.

- Short (going short): When a trader takes a short position, they are selling a currency pair with the expectation that its value will fall over time.

- Bullish: This is an optimistic trading sentiment about the future performance of a currency pair. When a trader is bullish, they expect prices to rise and may take long positions, anticipating to profit from upward price movements.

- Bearish: This is a pessimistic trading sentiment about the future performance of a currency pair. When a trader is bearish, they expect prices to fall and may take short positions anticipating to profit from falling prices.

- Pip (Percentage in Point): A pip is a standard unit of price movement in the Forex market, representing a measure of price change in a currency. For most currency pairs, a pip is the fourth decimal place in the price quote or exchange rate. For currency pairs quoted to five decimal places, the fifth decimal place is referred to as the “point”. A point is a 1/10th fraction of a Pip and is usually the smallest increment in price in the Forex market.

- Lot (or lots): Is a reference to the quantity of currency being bought or sold. The standard lot size in Forex trading is 100,000 units of the base currency. However, lots can also be traded in different sizes, such as mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units). The higher the lot size traded, the more you could potentially profit or lose from the same price movement.

- Leverage: Leverage in Forex trading allows a trader to increase the size of a trade beyond the limitations of their account balance. For example, trading with 1:30 leverage means a trader can open trades that are 30 times larger than the amount they have available in their trading account. With 1:500 leverage, a trader can open trades valued at $500 with just $1 as margin. While leverage can amplify a traders potential to profit, it equally amplifies the risk of loss.

- Margin: This is the amount of money that needs to be deposited with a broker to open a trade. Margin is used as collateral to maintain open deals and allows leveraged trading.

- Liquidity: High liquidity means that a pair can be traded in large volumes very easily without causing fluctuations in price when the transaction takes place. Liquidity refers to how easily or quickly a currency pair can be bought or sold.

- Volatility: Refers to the rate or range of price change over a specific period of time. It's a gauge of the potential risk and reward associated with trading any specific currency. High volatility indicates significant price movements, while low volatility indicates less or more stable price movements.

How to trade Forex

When it comes to trading in the Forex market, two primary methodologies stand out for predicting price movements. Forex traders use technical analysis and fundamental analysis to help them anticipate price movements and make better informed trading decisions.

Continue reading to learn more about them.

Technical analysis vs fundamental analysis

Technical analysis is the art of predicting price movements based on historical data using charts. Traders learn how to read and analyse candlestick charts to price trends, price levels and chart patterns, to find potential entry and exit prices and to time the execution of their trades.

Technical analysis is more popular among Forex traders, especially shorter-term traders, who aim to capitalize on quick price fluctuations. The primary advantage of technical analysis over Fundamental analysis, is its ability to provide visual insights into market behavior. However, some critics argue that it may overlook the overarching factors that broadly impact a currency pair's performance.

This is where fundamental analysis comes into play, as this methodologies tries to evaluate a currency's intrinsic value. This method involves analysing a country's macroeconomic indicators, like GDP, inflation, interest rates and employment data to broader understand whether it is strong or weak. Fundamental analysis is typically favored by long-term traders or investors who focus on an economy’s potential to perform over time.

While fundamental analysis offers a comprehensive understanding of a country’s economic health and future prospects, it can be time-consuming and may overlook the short-term trading opportunities and precision that technical analysis offers.

With that being said, the best traders use both technical and fundamental analysis to help them make better informed trading decisions.

Let's dive a little deeper into this.

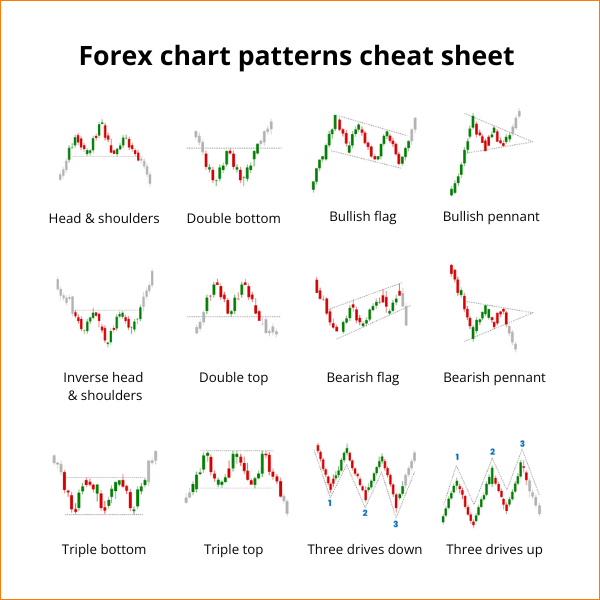

Common Forex trading chart patterns

In technical analysis, Forex traders use chart patterns to identify market sentiment and anticipate future price movements. Technical analysts largely believe that the market exhibits recurring patterns and what happened in the past is likely to happen again in the future. Chart patterns help to provide a visual reference of this and trades can be placed in anticipation of a certain pattern being completed.

Chart patterns are typically categorized as either continuation or reversal patterns. Continuation patterns can potentially indicate a continuation of an established price trend. While reversal patterns can potentially indicate the end or a reversal of an existing trend.

Here are some common Forex trading chart patterns that traders look for:

Head and shoulders (inverse head and shoulders)

The head and shoulders chart pattern is one of the most well known chart patterns used by traders to predict potential reversals in the price trend. It is characterized by a distinctive baseline with three peaks, where the outer two are close in height and the middle peak is the highest of the three. It resembles a silhouette of a head with two shoulders on either side and can potentially indicate a reversal of an up trend. The inverse head and shoulders chart pattern can potentially indicate a reversal of a downward trend.

Flags and pennants

Flags and pennants are trend continuation chart patterns that are frequently observed in markets that exhibit strong bullish or bearish price trends. This pattern consists of an impulsive price move up or down with a brief price consolidation period, before the market continues in the direction of the prevailing trend. Although they are similar in nature, the consolidation periods vary slightly, giving the flag or the pennant a distinct identification and name.

Double top and double bottoms

Double tops and double bottoms are also very common chart patterns that are prevalent across various financial markets. They are easy to spot and both can potentially indicate a reversal of the price trend. The double top Forex chart pattern is a bearish reversal pattern that appears after the price of a currency pair has been in an uptrend. The double bottom is the inverse reversal pattern that appears after the price of a currency pair has been in a downtrend.

Triple top and triple bottoms

The triple top and bottom chart patterns are similar to the double top and double bottom chart patterns. The only difference is there is a third peak in the pattern. These too are price reversal patterns that can potentially indicate a reversal of the price trend. Open any price chart and see if you can spot them at the significant turning points.

The chart patterns described here represent just a fraction of the chart patterns Forex traders use. Numerous other patterns also play a pivotal role in the technical analysts toolbox, each offering their own insights into Forex market dynamics and potential future price movements.

The application and effectiveness of these patterns can vary based on market conditions, time frames viewed, and the subjective interpretation of the practitioner. So incorporating these technical indicators, alongside other analytical tools, can help enhance trading strategies and decision-making.

Keep reading to learn more.

Economic indicators that move Forex markets

Economic indicators are the cornerstone of fundamental analysis in Forex trading, helping traders predict potential price movements. Here are 7 important economic indicators every trader should know, and pay attention to when trading Forex.

Interest rate decisions

Central banks control the official interest rates in their countries, and their decisions have profound impacts in the Forex market. Higher interest rates encourage saving and offer lenders in an economy a higher return relative to other countries. While lower interest rates encourage spending and offer borrowers in an economy access to cheaper capital for investments. Higher interest rates attract foreign capital and creates demand for a currency, potentially causing a rise or fall in exchange rates. Interest rates are also the primary tool of Central banks to control inflation, this economic indicator is far reaching and probably one of the most important.

Gross Domestic Product (GDP)

GDP is the broadest measure of a country's economic performance, as it provides an overview of the total economic output and health of an economy. A rising GDP figure indicates a strong economy, which in turn generally leads to a stronger currency, because traders and investors seek higher returns in growing markets.

Non-Farm Payrolls (NFP)

The NFP report shows the number of jobs added or lost in the US economy over the previous month, excluding farming related employees. This indicator usually causes high volatility in the Forex market when it is announced and traders pay particular attention to it. Strong job growth signals a healthy economy, which often leads to increases in interest rates and the strengthening of the USD versus other currencies.

Unemployment rates

These indicators measure the percentage of the total workforce that is unemployed and actively seeking employment. A decreasing unemployment rate often correlates with a strong economy, and this supports the national currency due to anticipated interest rate hikes and economic growth (GDP).

Retail sales

This is a monthly measure of all goods sold by retailers based on a sampling of retail stores of different types and sizes. It is an important economic indicator of consumer spending and correlates strongly with consumer confidence and economic health. Increasing retail sales often supports the currency due to the potential rise in inflation and economic vitality (GDP).

Consumer (CPI) & producer (PPI) price indices

CPI measures inflation by tracking the changes in prices for a basket of consumer goods and services. While PPI measures the average changes in selling prices received by domestic producers for their output. Both are key indicators of inflation because producers pass higher costs for goods and services on to consumers. Higher inflation typically leads to interest rate hikes, which can attract foreign capital to a currency, potentially boosting its value.

You can stay informed with economic events with our economic calendar, which tells you when specific economic data will be announced and the potential impact it can have in the Forex market.

Risk management and position sizing

Effective risk management and position sizing are also foundational elements in Forex trading and are essential components of an effective trading strategy. Risk management involves identifying, assessing, and deciding how to address risks when trading. It's about making calculated decisions to navigate the inherent uncertainties in the Forex market.

While position sizing is the process of determining how much of your capital to allocate to a specific trade based on the risk assessment. It's an essential aspect of risk management that can significantly impact overall performance.

Combined, these two components help traders control risk, while simultaneously maximizing their potential to profit. Here are some common tools and techniques traders use:

- Stop-loss orders: Setting stop-loss orders can limit potential losses by automatically closing a position when the price adversely moves against you and reaches a specific price. This is an integrated feature on the trading platform.

- Take-profit orders: Setting take-profit orders can enhance potential profits by automatically closing a position to take profits when a currency pair reaches a specific price. This is also an integrated feature on the trading platform.

- Risk vs reward ratios: Assessing the potential risk compared to the potential reward of a trade idea can help in deciding whether a trade is worth taking.

- Diversification and hedging: Spreading trades across various currency pairs, can potentially reduce the impact of poor performance in any single currency.

- Assessing volatility: Understanding the volatility of the currency pair can guide you in deciding how much risk or what lot size to take on.

Forex trading psychology and emotional control

The Forex market is not just a reflection of exchange rates and economic data; it is also a battleground of human emotions. It is a place where the fear, greed, hope, and regret of traders creates price volatility just as much as any technical or fundamental indicator can. After all, it is the sentiment and actions of the buyers and sellers that affects prices.

Therefore, how a trader manages their emotions can significantly impact their trading performance through the actions they take. Traders who succeed in the Forex market often exhibit certain psychological characteristics, including:

- Patience: Waiting for the right trading opportunities rather than forcing trades.

- Discipline: Following a predefined trading plan with consistency.

- Detachment: Viewing trading as a business, where losses are seen as part of the game and don't evoke a strong emotional response.

- Confidence: Having faith in their analysis and trading strategy, avoiding second-guessing every decision.

- Resilience: Learning from mistakes rather than being discouraged by them, and using setbacks as a foundation for improvement and growth.

This is where a well-constructed trading plan can help, as it serves as a roadmap for navigating and trading in the Forex market.

Adherence to a trading plan can help traders avoid impulsive decisions by providing a framework that encourages discipline and consistency.

Common Forex trading styles & strategies

If you’re new to the Forex market or someone who has recently started your Forex trading journey, understanding the various trading styles and strategies is important to finding your path to success.

Just because one trading style or strategy works well for one person, it doesn’t necessarily mean that it will work well for someone else. Furthermore, not all trading styles and strategies will be suitable for you. Each approach also requires a slightly different psychological temperament and level of dedication.

Here is a list of the common Forex trading styles and strategies, you can pick one that resonates best with you.

Scalping

Scalping is a strategy or style of trading that involves executing many trades throughout the day with the goal of making small profits on very short-term price changes. Scalpers thrive in a volatile market and must be ready to react swiftly to the smallest of price movements. This strategy demands a significant amount of time and focus, as well as a deep understanding of market trends. Scalpers typically use high leverage to amplify their small profits, which also increases the risk.

Day trading

Similar to scalping, day trading involves buying and selling currencies within the same trading day. However, day traders usually execute fewer trades compared to scalpers and aim for slightly larger profit margins. The goal here is to capitalize on intraday market movements. Successful day trading requires a solid grasp of technical analysis, market news, and an ability to remain calm under pressure.

Swing Trading

Swing trading is a medium-term strategy that involves holding positions for several days or even weeks to capture market swings. Swing traders tend to look for "the next big move" in the market, and this style requires patience and a keen understanding of market trends and reversals. Swing trading is less time-intensive than scalping or day trading, making it suitable for most traders who cannot constantly monitor the markets.

Trend trading

Trend trading is another medium-term strategy that involves identifying and following the market's direction (or trend). Traders may use various technical and fundamental indicators to determine the strength and direction of the dominant trend. The key philosophy here is "the trend is your friend," and positions are typically held as long as the trend continues. Patience is a virtue, as trend traders must be willing to hold through market corrections.

Carry trading

Carry trading is a longer-term strategy that compliments trend trading. It involves borrowing in a currency with a low-interest rate and investing in a currency with a higher interest rate to profit from the interest rate differential. The risk here lies in the potential for exchange rate fluctuations to erase interest gains. Carry trading is more suited to a stable market environment or when the longer term price trend is in favor of the higher yielding currency. This style or strategy requires thorough fundamental analysis into various countries’ economic policies and interest rates.

News Trading

News trading capitalizes on the volatility sparked by major economic news announcements, such as interest rate decisions, employment reports and GDP data. Traders using this strategy must be quick to interpret news and react swiftly to its potential impact on currency pairs. Success in news trading depends on a sound understanding of economics and the ability to predict how news will affect currency values in the short term.

Why trade Forex?

24 hour trading is available as standard

The Forex market's unique advantage is that it's open 24 hours a day, 5 days a week. This continuous trading window allows participants to respond promptly to trading opportunities created by global economic events and news releases. Forex traders can trade at any hour, as the market caters well to different time zones and individual schedules. The flexibility Forex trading provides is particularly advantageous for those balancing multiple commitments.

Forex has a powerful combination of liquidity and volatility

As the most liquid market in the world, Forex offers quick execution of trades with minimal price impact. This deep liquidity ensures that traders can enter and exit positions with ease, even during times of high market volatility.

Low transaction fees

Another compelling reason why to trade Forex is the advantage of minimal or low transaction fees. In Forex trading, the primary trading fees involved come from the spread, and or the separate commission depending on the account type.

The costs associated with spreads and commissions are significantly lower in the Forex market compared to other trading environments. Setting up a trading account incurs no charges, and depositing or withdrawing funds is convenient and often cost-free. This enhances its appeal as Forex trading is both easily accessible and cost-efficient.

Ability to profit in rising or declining markets

Forex trading provides the potential to profit whether the market is going up or down. By taking long positions, traders can benefit from rising prices, whereas short positions allow traders to profit from declining prices. This enhances your ability to navigate through various market cycles and take advantage of circumstances related to economic expansion or contraction. The capacity to adapt trading strategies to different market trends underscores the dynamic potential of Forex trading. It is recession proof!

Low starting amount

Unlike the other financial markets that might demand a hefty initial investment, you can get started with Forex trading with as little as $20. This is a key factor in Forex's widespread appeal, as it offers newcomers the opportunity to experience trading with a relatively small financial commitment.

Scalability

Forex trading is favored by many for its scalability because it allows you to start small and gradually increase your trading volume as your experience, confidence, and capital grows. The ability to trade in various lot sizes, ranging from nano lots (1,000 units) and up to many multiple standard lots (100,000 units), provides a flexible approach to managing risk and potential reward.

Getting started with Forex trading

Now that you know what Forex trading is and how it works, you might be considering getting started. If you do, there are a few basic things you should do next.

- Learn more about how the Forex market works and how to trade it.

- Choose a trusted broker.

- Register a trading account and deposit money.

Forex trading education resources

So now that you have a comprehensive overview about what Forex trading is and how it works, it's time to dive deeper into the topic. Fortunately for you, we have created a plethora of Forex trading education resources designed to help traders at all levels refine their understanding of the Forex market and refine their trading strategies.

Succeeding in the Forex market isn’t about luck, it demands a certain level of understanding and to treat it like a serious business. So here is a quick guide to empower your Forex trading journey.

Forex trading video course

Start your Forex trading journey with our comprehensive Forex trading video course. Learn how to trade Forex from a seasoned veteran in just 3 hours with 15 video lessons. Understand the basics and fundamentals to more advanced topics. This course is meticulously designed to help you become proficient in Forex trading.

Forex trading ebook

Grab yourself a copy of our Forex eBook - Forex Decoded, to learn how to maximize your potential in the currency markets. "Forex Decoded" is your complete guide to the Forex market, giving you the knowledge and tools you need to navigate the Forex market effectively.

This is what you will learn:

- How to cultivate a winning traders mindset: Empower yourself with in-depth knowledge to start trading Forex with confidence.

- Developing your trading strategy: Learn strategies and tips to enhance your performance and maximize your potential.

- Learn risk management techniques: Discover how to guard your hard-earned capital and minimize trading losses.

Forex trading education blog

Enhance your Forex trading knowledge by exploring the vast library of articles on our blog. Each article is crafted to broaden your understanding and sharpen your trading knowledge. Learn about all aspects of trading, including what forex trading is and how forex trading works, money management, trading strategies and how to create your trading plan.

Read more Forex trading articles on our blog.

Register and fund a Forex trading account

Now that you are equipped with the knowledge about what Forex trading is and how it works, you might feel empowered to start trading. A trading account with a reputable Forex broker is a necessity to facilitate your trading.

If you haven’t already got an account we have got you covered, just follow these simple steps and you will be ready to start trading in no time.

1. Register your account

Register your account with TIOmarkets, it only takes a few minutes and this will take you to your secure client portal.

2. Create a demo or live account

Create your demo or live account in your secure client area, and choose the account type, trading platform, account base currency and set the leverage. The log in credentials will be sent to you by email.

3. Download the trading platform

Go to the download centre and download and install the relevant trading platform to your computer or smartphone.

4. Deposit funds

Go to deposit, select your deposit method and enter your preferred amount. You can get started with an amount you are comfortable with.

5. Transfer funds to the trading platform

Once you have made a successful deposit to your TIOmarkets wallet, go to manage funds and transfer the funds from your wallet to the trading account you created in the previous steps.

6. Log in to your trading account

Open the trading platform and use the trading account log in credentials sent to you by email in the previous step to login. You should notice your balance reflects the amount you transferred and now you can start placing trades.

Now you know what Forex trading is and how it works

Now you know what Forex trading is and how it works, take the next step and empower yourself with this knowledge. Trading in the Forex market effectively demands a commitment to learning, as well as practical application and adapting to the markets dynamic through experience.

The journey towards becoming a proficient Forex trader is a cumulative process that takes time. It will have its challenges but with dedication and the right resources, trading in the Forex market can become a landscape full of opportunity with the potential for growth and success.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Experienced independent trader