Introducing Broker Program | The Ultimate Guide

BY TIOmarkets

|February 27, 2025An Introducing Broker (IB) plays an important role in the trading ecosystem by connecting individual traders to the financial markets. They do not hold client funds or securities, but instead help to facilitate access to these through brokerage firms.

Their primary function is client acquisition and to refer traders to open trading accounts with the brokerage firms they have partnership agreements with. Introducing brokers (IBs) essentially act as an intermediary between forex brokers and new potential clients.

In this guide, we will outline the steps to become an introducing broker, the benefits, as well as how to refer traders to earn commissions.

So without any further delay, let’s get started.

Your introducing broker guide

The introducing broker model is an advantageous one for both the brokerage firm, the client and the IB. For brokerage firms, working with IBs is a cost-effective way to acquire new clients without directly increasing their marketing costs. For clients, IBs can provide added value and personalized services. For the IB, they can earn commissions from the brokerage for the eligible clients they refer to open accounts and trade on the platform.

Introducing Brokers are an integral component of the online trading landscape, enhancing the online trading ecosystem by providing a bridge for clients to participate in global financial markets.

Introducing brokers vs forex affiliates

If you are interested in partnering with a forex broker, you have probably heard two different terms being used in the space. These are Introducing broker and affiliate - the two most popular options in the forex affiliate marketing industry.

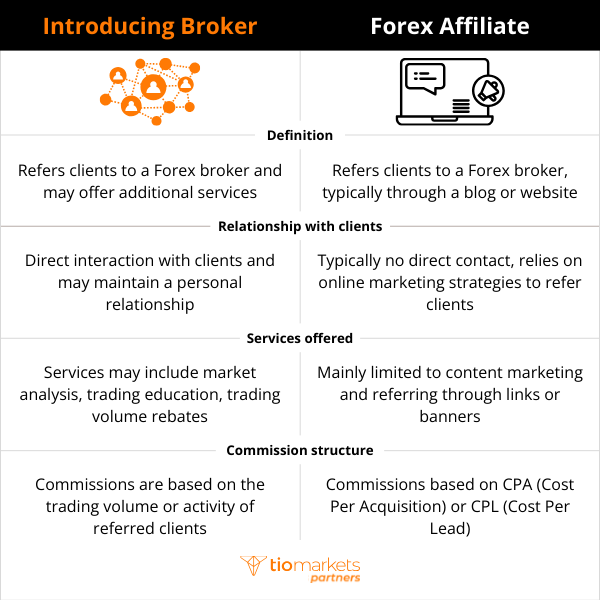

While both involve promoting forex brokers, referring clients to the trading platform and earning commissions, there are differences between the two.

Introducing Broker (IB)

This is an individual or a company that refers clients to a broker and receives compensation for each eligible referral. Introducing brokers can and often do provide additional services to their clients, to entice them to open trading accounts through them.

Forex Affiliate

Similarly, a forex affiliate can also be a person or a company that promotes a forex broker's services through various online marketing channels, and earns commissions based on the number of eligible referrals.

It sounds like they are both doing the same thing right? Well, they kind of are but the main differences are in the client relationship and the commission structure.

Introducing brokers usually maintain a relationship with the client after the referral has been made. While a forex affiliate typically has no direct contact with the client, their primary objective is online marketing and generating traffic and leads for the forex broker. Furthermore, introducing brokers earn commission based on trading volume rebates, while a forex affiliate earns a one time commission for referring eligible clients only.

Benefits of becoming an introducing broker

Becoming an introducing broker (IB) in the Forex market can offer a unique pathway to financial success and independence. This role not only positions individuals at the intersection of finance and client relations but also provides an environment ripe for opportunity and growth. Below, we explore some of the key advantages of stepping into this dynamic and potentially lucrative world.

Flexible income potential

One of the most enticing aspects of becoming an Introducing Broker is the flexible income potential paired with diverse commission structures. Introducing Brokers are essentially rewarded based on the activity and trading volume of the clients they refer, which means there’s a direct proportional relationship between an IB’s efforts in attracting and supporting active traders and their earnings. This performance-based model encourages IBs to continuously innovate and optimize their client acquisition and retention strategies, ensuring a dynamic and motivated approach to business growth.

Low startup costs

Unlike many other ventures in the financial markets, starting as an Introducing Broker comes with relatively low upfront costs. There's no need for extensive infrastructure or a physical office space; with a robust network and effective online presence, you can kickstart your IB business. This simplicity in operation allows individuals to focus on what truly matters—building relationships, enhancing their market knowledge, and refining their marketing strategies to attract and support clients.

Leverage the brokers infrastructure

Introducing Brokers benefit immensely from associating with established and reputable Forex brokers. By leveraging the broker's robust trading platforms, educational resources, and market reputation, IBs can provide significant value to their clients without the need for considerable investment in product development or technology. This symbiotic relationship not only enhances the IB's credibility but also allows them to offer a suite of services and support that might otherwise be beyond their reach.

Launching your introducing broker business

Starting your own Introducing Broker (IB) business can be exciting and challenging in equal measure. The financial markets are intricate and popular, and success as an IB demands more than just a fundamental understanding of trading.

Here are the essential steps to launch your IB business;

Develop financial market expertise

The cornerstone of a successful Introducing Broker business is a deep understanding of the financial markets. Prospective clients look to IBs for guidance and expertise, market insights, and education to help them navigate online trading and the financial markets. Therefore, developing your expertise and becoming a trusted source of knowledge will provide you with influence.

Partner with a reputable broker

Your choice of broker to partner with is also instrumental to your success as an IB. It's about more than potentially lucrative commission structures for you; it’s about aligning with a broker whose product and reputation amplify your ability to attract, convert and support clients.

The ideal broker should complement your vision, as your association will reflect on your brand and help establish trust and authority in the market place.

Marketing and client acquisition strategy

With a solid understanding of the financial markets and a reputable broker partner by your side, the next pivotal step is to build a strategic marketing and client acquisition plan. Given the competitive nature of the IB landscape, distinguishing your services is key. This includes identifying your target audience, understanding their needs and preferences, and crafting tailored communications that resonate with them.

Digital marketing should be a pillar of your strategy, encompassing content marketing, social media engagement, SEO, and email campaigns. However, don’t overlook the power of personal relationships and networking in building your client base. Attend industry events, webinars, and forums to connect with potential clients and partners.

Additionally, consider offering value-added services such as market analysis, trading signals, or educational content to differentiate your offering and foster client loyalty. Your marketing efforts should consistently communicate the unique value you bring as an IB, leveraging both online and offline platforms to reach and engage your target market effectively.

Launching an Introducing broker business requires a blend of industry knowledge, strategic partnerships, and targeted marketing efforts. By focusing on these key areas, you can set a strong foundation for your business.

Keep reading to learn how.

Step-by-step introducing broker guide

In today's digital age, having a robust virtual footprint can skyrocket your ability to attract and convert clients. Here's how you can create a commanding online presence with a website focused on search engine optimization (SEO), and strategic social media use.

Create a website and blog

Your website acts as your virtual home, it's the first port of call for potential clients seeking information about the financial markets and your services. To maximize its effectiveness, your website should be:

- Visually appealing: Employ a clean, modern, user-friendly design that reflects professionalism. Use high quality graphics and a color scheme that aligns with your brand.

- Mobile responsive: Ensure that the website is easy to navigate on smartphones and tablets. Design your website for the mobile user first, as most website traffic is now on mobile devices.

- Logical website structure: Have a clear menu structure that allows visitors to find information quickly.

- Content rich: Publish informative content regularly, provide high quality in-depth content on the topics your target audience is searching for.

Starting a blog can significantly enhance your online presence and set you up as an authority. Use the blog to provide valuable education, trading strategies, and insights into current market events.

Focus on SEO to improve online visibility

SEO and content creation should be at the heart of your online strategy. By optimizing your content for search engines, your website can rank higher in the search results, leading to increased visibility and more traffic. Here are some key SEO strategies to implement:

- Keyword research: Identify and target specific keywords related to trading that potential clients are searching for.

- High quality content: Publish well-researched and original articles that address the needs and questions of your target audience.

- On-page SEO: Ensure that your website's pages and blog posts are optimized for your target keywords, including title tags, meta descriptions, and header tags.

- Technical SEO: Improve your website's backend elements like site speed, mobile-friendliness, and ensure you have secure connections (HTTPS).

- Backlinks and interlinking: Gain authority by earning backlinks from reputable and relevant websites. Link related articles and web pages together to create topical clusters.

Create social media profiles

Social media is a powerful tool, as it offers unparalleled access to large audiences around the world. Furthermore, social media offers a platform on which you can share your content. This can encourage further traffic to your website to explore more of what you have to offer.

Here's how you can leverage the different social media platforms to turbo charge your introducing broker business:

- LinkedIn: Use this platform to connect with professionals in the industry and participate in relevant groups.

- Twitter: Share market news, quick tips, and interact with your audience in real-time.

- Facebook: Create a business page where you can share your blog posts, create event pages for webinars, and engage with your community.

- Instagram: Although more visual, use Instagram to share informative infographics and short videos.

- YouTube: This is the second largest search engine and the video content you upload can also appear in the search engines. Create tutorials, live streams and webinars to reach a vast audience.

- TikTok: Repurpose your long form content to create short fun content that could potentially go viral. The platform's algorithm is designed to promote content that users engage with.

When using social media, it's important to maintain a consistent publishing schedule. Also engage with your followers to better position yourself as an introducing broker to attract and refer clients.

Now that you have your virtual footprint set up, you can leverage paid advertising and other online marketing tools to speed up your results.

Powerful marketing strategies for introducing brokers

As we have already highlighted, social media marketing is an incredibly effective way to build a brand online, attract potential clients and engage with your audience. Platforms like Facebook, Twitter, Instagram, YouTube, and TikTok each have unique features and audience demographics.

Engaging with the audience is paramount but paid social media ads are an extension to this, allowing for precise targeting based on demographics, interests, behaviors, and more. Social media platforms provide rich analytics to gauge the performance of your campaigns, allowing for data-driven adjustments to improve return on ad spend (ROAS).

Pay Per Click (PPC)

Generating organic traffic will take some time to kick in and although it is possible to see results in the short term, paid advertising will speed things up. Pay Per Click (PPC) campaigns can be a cost effective form of advertising if you bid on the right keywords. The good thing about this type of paid advertising is you only pay when someone clicks on your ad. Google AdWords is the most renowned platform for PPC and it can be highly effective, when you target search terms that have high commercial intent.

Banner ads

Placing banner ads on relevant websites can also capture the attention of your target audience and place your business in front of potential clients. Finding the right sites that align with your brand and have significant traffic is crucial for the success of banner ads. Combine compelling visuals with a clear call-to-action and direct traffic to a lead capture page.

Once you have a lead, you can follow up, build a relationship and potentially convert interest into a new client.

Email marketing

Email marketing remains one of the most powerful ways to connect with potential and existing clients. It begins with building a robust offer – a task that usually involves offering value in exchange for a user's contact information. This could be in the form of a free ebook, or to join a webinar. The point is you can repurpose the content you have already created to serve as a “lead magnet”,

Once you've got people on your list, you can regularly communicate with them and promote your partner broker. The key to successful email marketing is maintaining the integrity of the people on your list and not to spam them.

Regulatory compliance for IBs

The regulatory landscape is always shifting, posing a challenge for brokers and IBs alike, that must keep pace and adhere to the changes. Forex brokers and online trading platforms have a significant responsibility to adhere to strict regulatory standards, which are designed to protect financial markets and retail traders.

Although introducing brokers don’t necessarily have to be authorized by a financial markets authority, they are required to be supervised and monitored by the brokerage they represent.

Key compliance obligations

- Anti-Money Laundering (AML) and Know Your Client (KYC): IBs and brokers need to adhere to AML and KYC protocols to prevent financial crimes. This includes establishing the identity of their clients and understanding the source of their clients' funds. The broker is responsible for requesting and checking the identification documents of all clients referred by the IB.

- Risk disclosures and transparency: Transparency in fee structures, conflict of interest and the relationship between the IB, the client and the broker is mandatory. Clients must be provided with fair and accurate information to make informed decisions. Trading financial products is a speculative and complex activity that generally has a high risk of clients losing money. Therefore, it is mandatory to include risk disclaimers on all marketing communications, and refrain from making misleading statements, about the products and services offered, as well as the outcomes from trading them.

Adherence to these compliance measures is not just a legal obligation for brokers, but forms the backbone of a trustworthy financial system. For IBs, a commitment to regulatory compliance should also be a business imperative, as it safeguards their reputation, the interests of the clients they serve and the brokerage firms they represent.

Signing up to an introducing broker program

If you're motivated by the prospect of becoming an integral part of the financial markets ecosystem as an introducing broker, then there's no better time to take action than now.

TIOmarkets invites you to join the team as an introducing broker. Our IB program ensures you have all the necessary tools, support, and guidance to start and grow your business.

- High earning potential: Get a customisable and generous commission plan with high earning potential.

- Popular trading platforms: Most traders prefer the MT4 & MT5 trading platforms and we provide both.

- Friendly support: Knowledgeable experts will help you grow your business and help your referrals to start trading

- Competitive trading conditions: Your clients get a good deal, increasing the likelihood that they will start and continue trading with us.

- Sponsorship available: High performing partners or IBs with potential can get additional marketing support

- In-depth reporting: Access systems to track and monitor every click and conversion to optimize your business

- Reliable payments: We pay your commissions on time, every time.

Take the first step by signing up for the TIOmarkets IB program today and receive a free consultation with our partnerships team. Become an introducing broker with TIOmarkets and realize your full potential.

IB program details

Sign up for a free consultation

Kick off your journey as a TIOmarkets Introducing Broker (IB) by scheduling a consultation with our dedicated partnerships team. During this session, we’ll explore your goals, target audience, and strategies to effectively introduce traders to our platform. This will ensure a smooth start and into our IB program.

Eligibility and onboarding process

Our introducing broker program is open to qualified partners worldwide. Once we confirm your eligibility, you'll receive a detailed partnership agreement with the company.

Access to the IB portal

Upon joining our IB program, you'll gain access to our user-friendly partners portal, where you can get your referral links, generate website banners, track your campaign performance and monitor your earnings in real-time.

Start promoting with your referral links

Utilize your unique referral links to direct traders from your network to our trading platform. Every time a referred client clicks on your link, registers an account and starts trading, their activity is tracked and attributed to your IB portal. This ensures that you receive the trading volume rebates you’ve earned.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.