Copy Trading Canada: Maximize your trading opportunity

BY TIOmarkets

|March 2, 2022Welcome to the world of financial markets copy trading—a space where an ever-evolving landscape demands savvy strategies and skills to succeed. One such strategy that has broken through the ranks and piqued the interest of Canadian traders is Copy Trading.

Copy trading, as the term suggests, involves copying or replicating the trades of other traders. When a trade is made by the person you are copying, the same trade is automatically executed in your trading account too.

Over the past few years, this passive form of trading has transformed into a strategic tool for both beginners and experienced traders, offering an opportunity to earn and tap into the expertise of others.

In Canada, the narrative around copy trading has gone from curiosity to meaningful utilization. The ease it offers in leaping over the steep learning curve, along with the potential for profits, makes copy trading incredibly enticing to many.

Whether you're an investing maestro or someone who's just dipping their toes into the water. Copy trading in Canada is an intriguing investment avenue you should explore further.

So sit back, relax, and let us embark on this journey together.

Sign up for copy trading as a strategy provider or a follower.

Understanding Copy Trading: How it Works

Peeling back the layers on copy trading can feel a bit like peering into a complex matrix of decisions and actions. However, when broken down into manageable steps, it becomes a constructive and comprehensible process.

Let's walk through how copy trading works in a step-by-step manner:

1. Select a copy trading platform

Your first step into the world of copy trading is choosing a reliable platform. Your trading platform of choice will act as your command center, offering a catalogue of experienced traders to follow and copy.

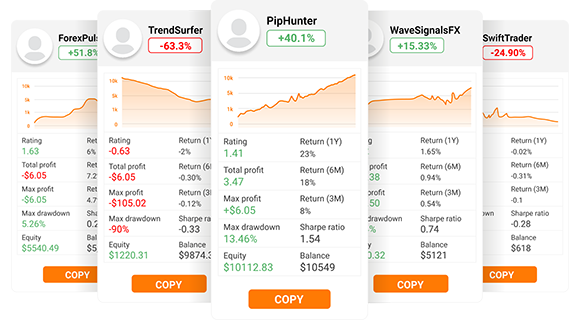

2. Choose a strategy provider to copy

Once your account is set up, you'll have to decide whose investments you want to replicate. Most platforms give detailed breakdowns of each trader's performance, investment history, and the risk they typically take.

3. Deposit and allocate funds

After selecting a trader, you'll need to allocate a portion of your funds for copy trading. These funds will then be used to copy the trades of your chosen trader.

4. Subscribe to the strategy provider

Upon clicking the 'copy' button, the chosen trader's trades will automatically be replicated in your investing account. When they make a trade, your account makes the same trade.

5. Monitor the trades

While copy trading can be relatively hands-off, it's good practice to monitor your investments. Ensure you're comfortable with the trades being made and make sure you adjust your settings if necessary.

Risks and rewards of copy trading

With copy trading, one can access several benefits, but it's important to be aware of the risks as well:

Risks of copy trading:

By utilizing copy trading, you are relying heavily on the performance of other traders. If their strategies don't pan out, it also reflects on your account.

Like every trading system, copy trading is exposed to the volatility of markets. There is always the potential of losses due to these unpredictable swings.

In copy trading, your trades are automatically made following the trader you're copying. Thus, you have limited control over individual investment decisions.

Rewards of copy trading:

For new traders, copy trading can be an educational tool, providing a practical platform to learn trading by observing experienced traders.

If the trader you're copying makes successful decisions, this can quickly translate to profits in your copy trading account.

Being primarily a passive strategy, copy trading can save time and effort spent analyzing financial markets and testing trading strategies.

Copy trading can be a rewarding form of trading if navigated with care. Understanding its risks and rewards is vital to successful copy trading in Canada, or anywhere for that matter.

The next sections will provide insights into enhancing your copy trading experience.

Tips for copy trading in Canada

Nestled within the alluring realm of copy trading in Canada is a universe of opportunity and, with the right strategies in your arsenal, it can serve a path for success. Here are some strategies for and tips on managing risks and diversification in copy trading.

Research thoroughly

While diving into the world of copy trading, it is crucial that you spend time researching and understanding your chosen trader's strategies and trading history. This step ensures you follow methodologies that align with your investment goals.

Start small

As a beginner, it's advisable to start with a smaller allocation of your total investment funds to copy trading. This approach safeguards your finances while allowing you to learn and adapt.

Diversify Your Traders: Don't put all your eggs in one basket, diversify! By copying multiple traders, you can balance out potential losses if one trader doesn’t perform as expected.

Set stop-losses

A significant tool in your risk management kit is the stop-loss order. This allows you to set a specific point at which your trade will close, protecting your investment from significant market dips.

Regularly review your strategy providers

Markets change and so do traders' performances. Regularly reviewing and replacing under-performing traders is good practice in copy trading.

Diversify your portfolio

In addition to diversifying your copy traders, ensure that your overall investment portfolio is diversified. Include different asset classes like stocks, bonds, and commodities to spread risk.

Remember, copy trading in Canada is not without its challenges. However, equipped with these expert tips, you can arm yourself to navigate through it successfully. The art of copy trading lies in the balance of taking calculated risks while reaping its benefits.

Copy trading platforms for Canada

Investing in financial markets can seem daunting but, a pivotal step in your copy trading journey is choosing the right platform.

TIOmarkets copy trading service offers an investment opportunity for both experienced traders and beginners alike. The platform is simple to use and has risk management tools, aiming to make investing in global financial markets seamless and effortless.

One of the primary benefits is the ability for users to follow and "copy" the strategies of top-performing traders in real-time. This eliminates the need to stay constantly updated with market market news or have extensive knowledge of trading. Trading has been simplified to such an extent, that you can tap into the expertise of others.

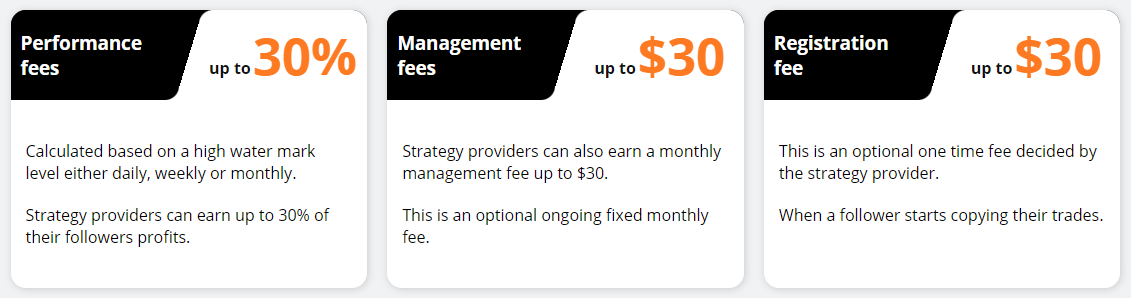

Another aspect of TIOmarkets copy trading service is that it doesn't just cater to investors, but also presents an opportunity for traders to become strategy providers. As a strategy provider, you can publish your performance to attract followers. The rewards can be quite substantial, strategy providers can earn up to 30% of their followers' profits and up to $30 in monthly management fees.

For followers, the focus isn't just on the potential earnings but also efficiently managing risk. The platform's built-in risk management tools ensure that you have complete control over lots sizes being copied and when to stop following a provider. Allowing you to customize the copy trading experience by aligning your risk tolerance with your account balance and investment goals.

Conclusion

The importance of performing rigorous research on the traders you intend to copy is paramount. Starting with small investments and steadily increasing based on comfort and strategy provider competency is a solid approach.

Furthermore, diversification, in terms of both your investment portfolio and the traders you decide to copy, cannot be overstated.

Are you ready to get started?

Sign up for copy trading as a strategy provider or a follower.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.