Bitcoin makes a new all-time high

BY TIOmarkets

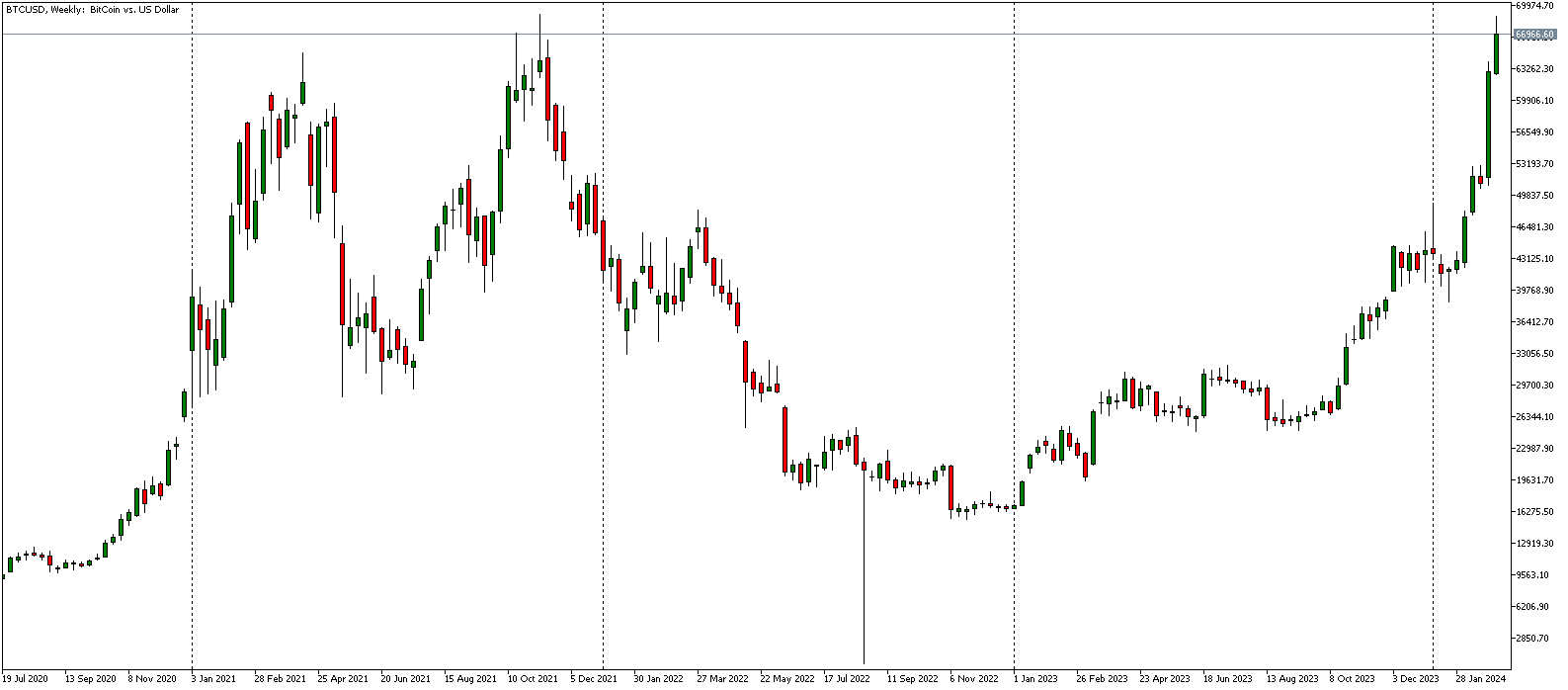

|March 5, 2024Recently, Bitcoin has come into the spotlight once again with its rise in value, as it approaches making a new all-time high. On Monday, 4th March 2024, Bitcoin reached a high of $68,827, coming close to topping the previous record of $69,030 on November 7th, 2021.

The recent price action brings back enthusiasm and bullish sentiment for the cryptocurrency as it continues its rise since January 2023. Despite some relatively minor pullbacks, Bitcoin has managed to sustain an upward trend from its lows in November 2022.

Bitcoin makes a new all-time high

Market participants are closely monitoring its price movements and assessing the factors driving its comeback. While there is optimism for higher prices, challenges such as regulatory scrutiny and market volatility continue to underscore the need for caution in the excitement around Bitcoin's remarkable rally.

Possible factors driving Bitcoin's surge

This remarkable 338% rally comes on the heels of several events that have reshaped the cryptocurrency market. These include:

Approval of ETFs indexed to Bitcoin

The approval of exchange-traded funds (ETFs) indexed to Bitcoin by US securities regulators in January has played a key role in Bitcoin's recent rise. These ETFs open a broader base of investors to gain exposure to Bitcoin without the complexities of direct ownership. The newfound accessibility has brought fresh capital into the market, fuelling demand and driving prices higher.

Institutional endorsement and investor confidence

The institutional endorsements have come up as a significant catalyst behind Bitcoin's rally. This institutional backing shows the growing acceptance of Bitcoin as a legitimate investment asset but also instils confidence among retail investors.

Notable entities, including MicroStrategy, have continued to show confidence in Bitcoin by increasing their holdings. MicroStrategy, a software company, made headlines when it announced the purchase of an additional 3,000 bitcoins, bringing its total holdings to 193,000 bitcoins, valued at about $6.09 billion.

Anticipation of bitcoin halving

The anticipation surrounding the upcoming Bitcoin halving event has also increased investor optimism and contributed to Bitcoin's surge in price. Scheduled for April 2024, the event is expected to reduce the rate of new Bitcoin issuance, effectively increasing its scarcity.

The next halving event will reduce the block reward from 6.25 to 3.125 bitcoins per block. This reduction in supply is designed to mimic the scarcity of precious metals like gold and is one of the key factors driving Bitcoin's value proposition as a deflationary digital asset.

This scarcity driven narrative has historically led to surges in Bitcoin's price, as investors anticipate a supply crunch that could potentially send prices higher.

Impact of US Federal Reserve's monetary policy

The monetary policy decisions of the US Federal Reserve have also influenced Bitcoin's recent price movements. Hopes of interest rate cuts amid easing inflationary pressures have increased sentiment towards Bitcoin. Bitcoin's capped supply makes it attractive to investors worried about unchecked money printing eroding fiat currency values.

Market analysis and price movements

Market analysts have closely been monitoring the factors driving Bitcoin's rally, which we mentioned above, leading to increased trading volumes and heightened investor activity.

Bitcoin's price movements have been characterized by periods of rapid ascent punctuated by short-term corrections for over a year now. The cryptocurrency's volatility, while inherent to its nature, has not put off investors from participating. Instead, many view Bitcoin's volatility as an opportunity.

While Bitcoin's surge has caused enthusiasm, some cautionary voices have warned of potential risks and challenges ahead. Regulatory uncertainty, market manipulation, and geopolitical events could all impact Bitcoin's price trajectory in the coming months. Additionally, the possibility of profit-taking remains a factor to consider amid the cryptocurrency's rapid ascent. It is to be seen whether price will bounce here, validating a long term resistance area or if the market will manage to convincingly break through.

Conclusion

While Bitcoin is on the verge of a new all-time high, the future trajectory of the cryptocurrency's price remains a topic of intense speculation. While the recent rally has increased optimism and excitement among market participants, it's important to consider the broader context and potential challenges that could shape Bitcoin's journey in the coming months and years ahead.

Ultimately, Bitcoin’s future outlook hinges on factors such as market sentiment, regulatory dynamics, technological innovation, and macroeconomic trends. While the future remains uncertain, one thing is clear: Bitcoin has emerged as a transformative force in the global financial landscape, challenging traditional notions of money and reshaping the way we think about value and ownership.

It's essential to approach Bitcoin with caution, diligence and perspective as it is a highly volatile instrument.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.