7 Economic Indicators Every Trader Should Know

BY TIOmarkets

|March 5, 2024Economic indicators are one of the most valuable tools every trader should know about. Because staying ahead of the curve means understanding the economic forces that drive market movements.

You can think of economic indicators as your guide through the financial markets. These indicators, which range from employment figures to inflation rates, act as signposts, offering valuable insights into the health and direction of economies worldwide. When economic conditions are strong, it should have a positive effect on the stock market and national currency. Conversely, when economic conditions are weak, it should have a negative effect.

In this article, we will outline 7 economic indicators every trader should know about. So, let’s explore what they are and why traders pay attention to them.

You can keep track of these economic indicators, as well as see their historical effects on price with our economic calendar.

Let’s get started.

1. Interest Rate Decisions

Interest rates directly influence borrowing costs and investment decisions, currency values, and market sentiment. Here’s how:

Impact on borrowing costs and investment decisions

When central banks raise interest rates, borrowing becomes more expensive. This can lead to reduced consumer spending, slower business investment, and a cooling of economic activity. Conversely, when central banks lower interest rates, borrowing becomes cheaper, stimulating spending and investment and potentially boosting economic activity growth.

Influence on currency values

Raised interest rates are generally seen as bullish for the currency, while lower rates are generally seen as bearish for the currency. As a result, increased demand for the currency can drive its value higher. Conversely, lower interest rates may deter foreign investment, leading to a depreciation of the currency.

Market reaction to interest rate decisions

Announcement of interest rate decisions by central banks often triggers significant market volatility. You should closely analyze central bank statements and economic data leading up to these decisions to anticipate potential outcomes and adjust your trading strategies accordingly. Positive surprises, such as unexpected interest rate hikes, can cause sharp rallies in the currency, while disappointments may lead to rapid declines.

Therefore, understanding interest rates and their implications is essential for navigating the foreign exchange market.

2. Central Bank Policy Statements

The second economic indicator every trader should know is policy statements from central banks. These are official communications issued by central banks alongside their interest rate decisions. These statements offer valuable insights into the central bank's monetary policy outlook, economic assessments, and future policy actions. They serve as crucial documents for understanding the reasoning behind central bank decisions and their implications for the economy.

Policy statements influence the financial markets and are closely looked at by traders for several reasons:

Monetary policy outlook and guidance

Central bank policy statements provide clarity on the direction of monetary policy by offering guidance on potential future interest rate decisions and policy actions. You should analyze these statements to anticipate potential shifts in monetary policy stance, which can significantly impact currency values, interest rates, and market sentiment.

Economic assessment and outlook

Policy statements usually include central banks' assessments of current economic conditions and outlooks for future growth and inflation. You should closely examine these assessments to gauge the central bank's views on economic health and potential risks, which can help you form trading strategies based on expected market reactions.

Forward guidance

Central banks may use policy statements to provide forward guidance on their policy intentions, offering markets insights into the expected potential trajectory of interest rates and monetary policy measures. You should interpret this guidance to assess the likely path of future policy actions and adjust your trading positions or strategy accordingly to capitalize on potential market movements.

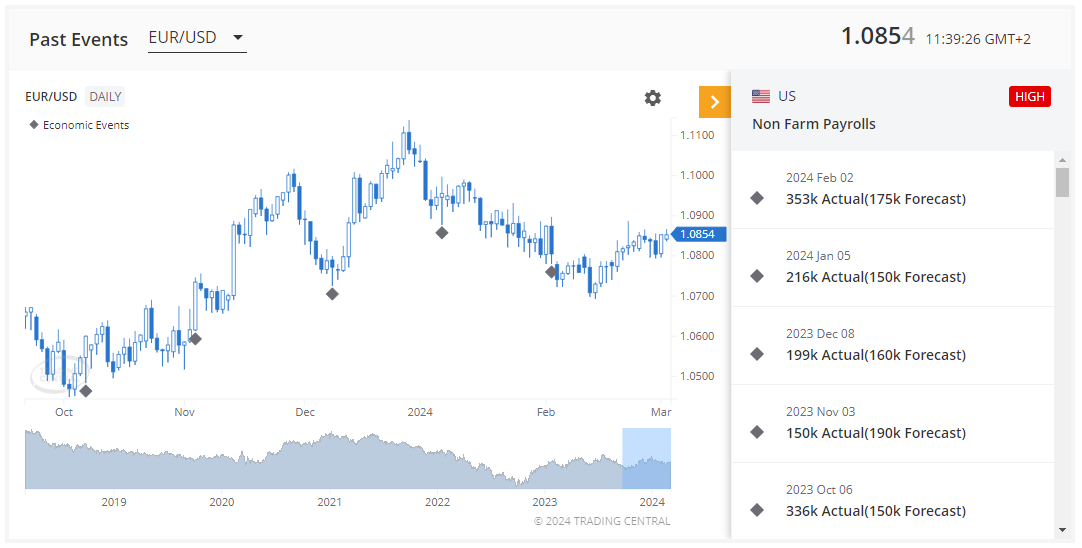

3. Non-Farm Payrolls (NFP)

The third economic indicator every trader should know about is the Non-Farm Payrolls (NFP) report. It is released monthly by the US Bureau of Labor Statistics, and is usually on the first Friday of each month. The NFP report offers a snapshot of employment dynamics and an overall assessment of economic health. It excludes farm workers, government employees, private household employees, and employees of nonprofit organizations, giving a focused analysis of the nation's labour market health.

Employment data

You can potentially benefit from NFP figures and all employment data in general, including the unemployment rate and job creation statistics. These indicators collectively give a detailed picture of the labour market's health, impacting consumer spending patterns and shaping the overall economic landscape. Observing employment data allows you to make more informed decisions about potential market movements.

Unemployment rate

The unemployment rate measures the percentage of people actively seeking employment. This metric is a critical gauge of labour market strength and directly influences consumer spending power. A declining unemployment rate often correlates with increased consumer confidence and spending, affecting various sectors of the economy and the financial markets.

The NFP report holds significance for you as a trader because of its great impact on market sentiment and economic outlook. Here's why you should closely monitor NFP releases and related employment data:

A key indicator of economic health

As a primary measure of employment trends, the NFP report offers a clear indication of the nation's economic health and labour market strength. Positive NFP figures suggest a thriving job market, and are typically associated with increased consumer confidence, higher consumer spending, and overall economic expansion. Conversely, weak NFP numbers may signal economic challenges, influencing investor sentiment and market movements.

Influence on central bank policy

Central banks closely inspect employment data, including NFP reports and unemployment rates, when formulating monetary policy decisions. Persistent trends in employment figures can make central banks adjust interest rates and implement financial policy measures to support economic stability and achieve objectives. You should closely analyze NFP releases to anticipate potential shifts in central bank policy direction, which can significantly impact currency values and market sentiment.

Market reaction to NFP releases

The NFP data often triggers high market volatility, particularly in currency, equity, and bond markets. Positive surprises, such as stronger-than-expected job creation, may lead to rallies in the US Dollar. Conversely, weaker-than-expected NFP figures can cause risk aversion and drive the value of the US Dollar down. You should quickly react to NFP releases, adjusting your positions based on the revealed employment trends.

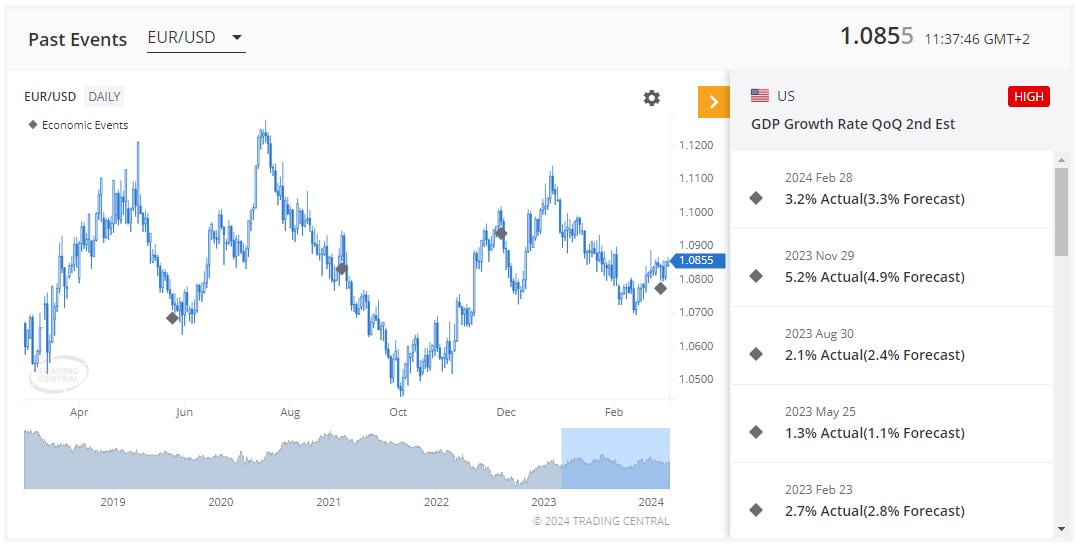

4. Gross Domestic Product (GDP)

The fourth economic indicator every trader should know about is Gross Domestic Product (GDP). It stands as a fundamental measure of a country's economic performance and health, representing the total value of all goods and services produced within its borders over a specified period.

GDP figures have a significant influence over the forex market due to the following reasons:

Indicator of economic health

GDP growth reflects the vitality and resilience of an economy. Strong GDP growth signals strong economic expansion, increased consumer spending, and heightened investor confidence, which are factors that tend to strengthen the country's currency. Conversely, weak GDP growth or contraction may signal economic challenges, leading to potential currency depreciation as investors seek safe havens.

Implications for monetary policy

Central banks closely monitor GDP data when putting together monetary policy decisions. Strong GDP growth may cause central banks to tighten monetary policy by raising interest rates to curb inflationary pressures. In contrast, sluggish GDP growth may prompt accommodative measures, such as interest rate cuts or quantitative easing, to stimulate economic activity. You should carefully analyze GDP reports to anticipate potential shifts in monetary policy, which can have significant implications for currency values.

Market reaction to GDP releases

The release of GDP data often triggers immediate market reactions in the forex market. Positive surprises, such as higher-than-expected GDP growth, may lead to the appreciation of the country's currency as investors interpret the data as a sign of economic strength. Conversely, disappointing GDP figures could lead to currency depreciation as investors reassess their outlook on the economy and adjust their trading positions and strategies accordingly.

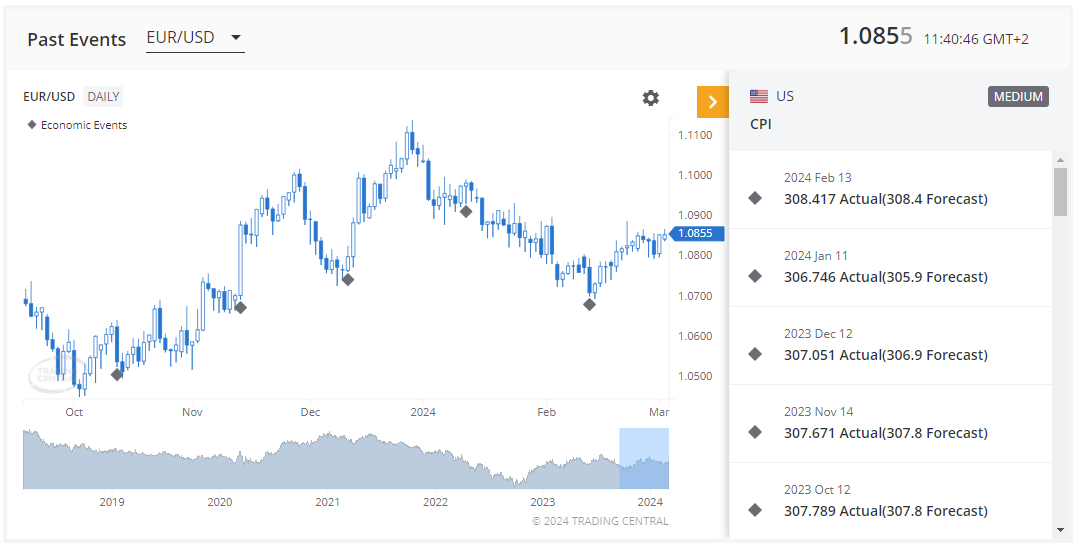

5. Inflation Indicators (CPI & PPI)

The fifth economic indicator every trader should know is inflation indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI). They provide insights into the rate at which prices for goods and services are rising within an economy. Here is a breakdown of the two and how you can use them for trading:

CPI: Consumer Price Index

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a basket of goods and services. You should closely monitor CPI data to assess the level of inflationary pressures within an economy. Rising CPI figures indicate increasing consumer prices, potentially signaling higher inflation rates and impacting consumer spending patterns.

PPI: Producer Price Index

The Producer Price Index (PPI) measures the average change in selling prices received by domestic producers for their output. You should use PPI data to evaluate inflationary pressures at the production level. Changes in producer prices can influence consumer prices downstream, affecting overall inflationary trends and consumer purchasing power.

They also have an impact on economic conditions and central bank policy responses, that’s why they hold significant importance for you as a trader.

Impact on central bank policy

Inflation indicators play a crucial role in shaping central bank policy decisions as they closely monitor CPI and PPI data to assess inflation trends and determine appropriate monetary policy responses. A persistently high CPI may prompt central banks to raise interest rates to control inflationary pressures, while low inflation could lead to monetary easing measures. You should anticipate central bank responses to inflation data releases, as these policy decisions can have significant implications for currency values and market sentiment.

A gauge of economic health

Inflation is a critical measure of an economy's health. Sustained periods of high inflation can destroy consumer purchasing power, reduce consumer spending, and hamper economic growth. Conversely, very low inflation or deflation may signal weak demand and economic stagnation. By monitoring inflation indicators, you can assess the overall health of an economy and adjust your trading strategies accordingly.

Market reaction to inflation data releases

The release of CPI and PPI data often triggers market volatility as traders assess the implications for future monetary policy actions. Positive surprises, such as lower-than-expected inflation figures, may lead to speculation of dovish central bank policies, potentially weakening the currency. Conversely, higher-than-expected inflation data could spark concerns about tightening monetary policy and strengthening the currency.

6. Retail Sales

The sixth economic indicator every trader should know is retail sales. Retail sales are an important macroeconomic measure tracking consumer demand for finished goods. These figures, put together by the U.S. Census Bureau, encompass purchases of both durable and non-durable goods across various retail sectors.

Here is why you should pay attention to retail sales data:

The pulse of the economy

Retail sales provide a snapshot of the economy's health and its projected trajectory and indicate whether the economy is on the path to expansion or contraction.

Indicator of consumer spending

As consumer spending accounts for two-thirds of the Gross Domestic Product (GDP) in the U.S., retail sales offer insights into consumer behaviour and spending patterns.

Timely and informative

One of the key strengths of retail sales data is its timeliness. As it is released monthly, the data is only a few weeks old, providing you with up-to-date information about economic health.

Market reaction

Healthy retail sales figures often create positive movements in currency and equity markets, as they signal a strong economy and higher earnings potential for retail companies. Conversely, a decline in retail sales may prompt investors to reconsider their positions and strategies, potentially affecting stock markets.

Influence on monetary policy

The Federal Reserve closely monitors retail sales data to assess economic health and guide monetary policy decisions. Understanding these trends can offer you valuable insights into potential shifts in interest rates and monetary policy direction.

Seasonality and special considerations

You should be aware of seasonal trends, particularly during peak shopping periods like the holiday season, that can significantly influence retail sales figures. Also, fluctuations in prices, especially in categories like food and energy, can impact sales data and market sentiment.

7. Political and Geopolitical Events

The last of the economic indicators every trader should know about are political and geopolitical events. These include a wide range of occurrences, including elections, government policies, diplomatic relations, international conflicts, and geopolitical tensions. Political and geopolitical events are significant drivers of forex market movements for several key reasons:

Investor sentiment

Political stability and effective governance help investor confidence and economic stability, typically leading to currency appreciation. Conversely, political uncertainty, government instability, or policy unpredictability can erode investor confidence, triggering capital outflows and currency depreciation.

Risk appetite

Geopolitical tensions, conflicts, or crises often heighten risk aversion among investors, leading them to seek safe-haven assets such as gold, the Swiss franc, or the Japanese yen. Consequently, currencies of countries perceived as safe havens may appreciate in times of geopolitical turmoil, while currencies of nations directly involved in conflicts or facing instability may weaken.

Policy implications

Political and geopolitical events can influence government policies, trade agreements, and international relations, all of which have implications for currency values. You should closely monitor policy announcements, diplomatic negotiations, and geopolitical developments to anticipate potential shifts in economic policies and their impact on currency markets.

Currency markets

Political and geopolitical events frequently trigger immediate market reactions in the forex market. News of election outcomes, policy changes, or geopolitical escalations can lead to sharp movements in currency prices as you reassess risk factors.

In summary, political and geopolitical events serve as crucial catalysts for forex market volatility, shaping investor sentiment, risk appetite, and currency valuations. You must remain on the lookout and stay informed about evolving geopolitical dynamics and their potential implications for currency markets to help you make well-informed trading decisions.

Here we will break down the three categories of political and geopolitical events:

Elections

Elections, whether national or regional, can introduce uncertainty into the forex market as investors assess the potential implications of new leadership or policy changes. You should closely monitor election outcomes and campaign rhetoric for clues about future economic policies and their potential impact on currency values. Political instability or unexpected election results can lead to heightened volatility and currency fluctuations.

Government Policies

Changes in government policies, including fiscal and monetary measures, can significantly influence economic conditions and currency markets. You should pay close attention to policy announcements, budget decisions, and regulatory changes, as these factors can affect inflation, interest rates, and investor confidence. Positive policy reforms may strengthen currency values, while adverse measures can lead to depreciation.

International Conflicts

Geopolitical tensions and conflicts, whether diplomatic disputes or military actions, can create uncertainty and risk aversion in the forex market. You should closely monitor geopolitical developments, such as trade disputes, territorial disputes, or geopolitical alliances, as they can impact global trade flows, investor sentiment, and market stability. Escalating tensions or the outbreak of conflicts may lead to flight-to-safety movements, driving demand for safe-haven currencies.

Conclusion

Understanding and monitoring economic indicators is essential for navigating the financial markets. Economic indicators serve as valuable signposts, offering insights into the underlying forces that drive market movements and price trends.

Each of these 7 economic indicators provides you with the critical information necessary to make informed trading decisions and anticipate market movements effectively. By paying close attention to these economic indicators, you can stay ahead of the curve and adapt your strategies to changing market conditions more effectively.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.